How Much Does It Take to Retire Comfortably in the UK?

The idea of finally retiring from work may fill some with joy – but it can also be a great source of anxiety. It is all well and good to dream of long summers, holiday homes and big family trips, but how much money do you need to fund a new life without a salary?

Ian Cook from Quilter Wealth Management stated, "Back in the day," defined benefit pensions meant that individuals generally did not have to be concerned about their pension income depleting since they received a lifetime guarantee of regular payments.

"Currently, within the realm of defined contribution schemes , you need to meticulously balance what amount you wish to have for your retirement with how extended you desire this financial security to last."

Telegraph Money below outlines ways to finance a comfortable retirement, and discusses reasons such as the possibility of retiring early and the expenses associated with care, which may require setting more money aside.

- What constitutes a comfortable retirement income in the UK?

- Ways to Boost Your Retirement Savings Pot

- Is it possible for you to retire prematurely?

- Are you looking for an extra push to grow your savings?

- Comfortable retirement FAQs

What constitutes a comfortable retirement income in the UK?

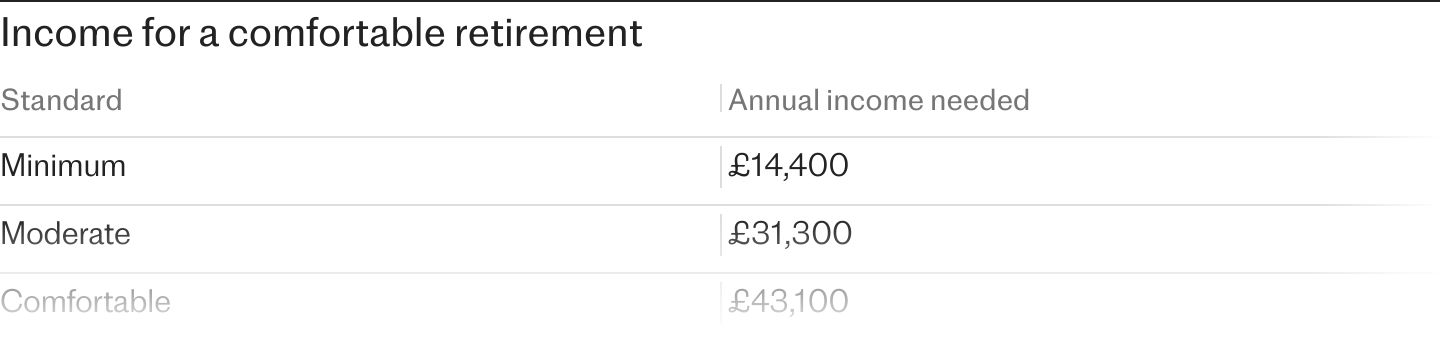

According to the Pension and Lifetime Savings Association (PLSA), a "comfortable" retirement involves having enough funds for indulgences like frequent spa visits, plays at the theatre, and an annual vacation of about two weeks somewhere in Europe. This lifestyle also allows approximately £130 per week for grocery shopping and £80 weekly for dining out experiences.

According to the study, this is anticipated to cost approximately £59,000 for a couple, or £43,100 for an individual.

A "moderate" retirement implies a way of living where you can enjoy some indulgences. This includes taking a one-week vacation in Europe and a long weekend trip within the UK annually, owning a modest used vehicle, and treating yourself occasionally. Weekly expenses might cover about £100 on food shopping, with an additional £60 set aside weekly for dining out.

With a minimal income, according to PLSA estimations, you would not be able to manage the cost of a vehicle; instead, you might opt for a holiday within the UK. This leaves less money available for essentials like groceries, clothing, and presents.

The table beneath illustrates the amount of pension income specialists believe you require annually based on your lifestyle choices.

Ways to Boost Your Retirement Savings Pot

These amounts might not seem unattainable, yet amassing a fund large enough to reliably provide such payments every year can be challenging—particularly since the total worth of your pension will vary based on shifts in the stock and bond markets.

To assist with financing the retirement you desire, contemplate adopting these strategies, encompassing schemes for both your state and private pension arrangements:

- Review your state pension projection – you can do this on gov.uk .

- Fill in gaps on your National Insurance record

- Increase pension contributions

- Boost your employer's contributions to your plan workplace pension

- Consider opening a Sipp

- Make lump sum contributions

- Invest wisely

- Maximise the use of what’s available. tax relief

- Cut unnecessary expenditure by budgeting

- Use the full Isa allowance

The initial step should be reviewing your state pension projection, since these governmental disbursements will serve as a valuable cornerstone for your retirement earnings.

You will be eligible for the complete amount. state pension If you've made 35 years' worth of National Insurance contributions, this can differ based on your work history — for instance, if you’ve ever been employed overseas, your total might be less. Therefore, it’s wise to verify this ahead of time. You can obtain an official state pension forecast through their website. government website .

Should there be breaks in your National Insurance history, you have the option to make up for them by paying voluntary contributions or claiming NIC credits to enhance your entitlements towards the state pension – You now have until April 4th to complete any missing sections. from 2006-07 onwards.

At present, the state pension age stands at 66; however, it’s gradually increasing to 67 by 2028 and has been established to climb further to 68 sometime around the mid-2040s. Should you wish to retire earlier than these ages, you would require a significantly larger personal or company pension to support your early retirement plans.

Are you able to retire prematurely?

It relies on various factors including your pension situation, savings, outstanding debts, and how you envision your retired life.

Technically, you could decide to "retire" and cease work at any age provided you have sufficient means to support yourself. However, for those intending to rely on their pension income, the minimum age at which they can typically withdraw from their personal pension fund is currently set at 55. The rationale behind this threshold aims to maintain an approximate gap of ten years below the qualifying age for receiving state pensions. Furthermore, this eligibility age is scheduled to rise to 57 by April 2028.

Our Step-by-step instructions for achieving an early retirement can help you prepare.

What amount of money do I require to retire at age 55?

As stated previously, this relies on the type of lifestyle you wish to sustain during your retirement years.

In order to support a comfortable standard of living, you'd require an additional pension sum of approximately £700,000 over your state pension, as per figures from Quilter. This amount would provide you with roughly £78,690 annually until you turn 82 years old. Should you live past this age, your savings would run out when you hit 88.

The tables underneath illustrate how the retirement age impacts the necessary size of the pension pot.

Awaiting your state pension payments can ease some of the stress. Should you continue working up until the present state pension age of 66, your savings would likely need to amount to approximately £450,000.

By the age of 84, which aligns with the average life expectancy, this amount could reach approximately £122,176. These numbers should always be considered because any remaining funds in your pension can be transferred without being subject to inheritance tax.

Refer to the tables below to understand the cost of a modest retirement when retiring early compared to continuing work past the state pension age.

Are you looking for an extra push for your savings?

Several situations might suggest the necessity of increasing your pension savings, such as:

- Marriage or divorce

- Economic instability

- Unexpected health issues

- History of familial longevity

- Tax changes

Many individuals anticipate requiring lesser funds as they advance in years, presuming they will venture out less frequently and settle all remaining debts – however, this might not hold valid if assistance with caregiving becomes necessary, noted Ian Cook from Quilter.

The "healthy" life expectancies for men and women stand at 63 and 64 years correspondingly; hence, you might require assistance for up to two decades if you reach your eighties.

Considering all these financial constraints, your retirement fund might be smaller than anticipated. Should this be the situation, it’s important not to worry since numerous strategies remain available for boosting your savings, particularly with the limits on lifelong pension contributions gradually being removed.

The lifetime allowance

The lifetime allowance has been scrapped. In the past, when it was enforced, it limited how much you could save – with the latest cap being set at £1,073,100. Should you surpass this limit, you would have faced taxation up to a rate of 55%.

Mr Cook stated: "Throughout your life, you might experience raises in pay, substantial bonuses, or unexpected gains through inheritances or other means. In such instances, consider directing some of that towards your pension."

The annual allowance caps How much money can you contribute to your pension? Tax-free allowance each year stands at £60,000, but decreases gradually for those with higher incomes.

For those who have already retired and are thinking about going back to work, a separate rule comes into play for contributing to their pension. Payments under this scenario fall under the "money purchase annual allowance," which is currently capped at a lower limit of £10,000.

Comfortable retirement FAQs

What amount of money does an average individual typically possess upon retirement?

According to the most recent statistics from the Department for Work and Pensions The typical single pensioner earns £13,884 annually. In comparison, for couples, this figure rises to £29,172 combined per year once housing expenses have been deducted.

See our Guide to the typical pension savings amount for more information.

For how long does my money need to be sufficient?

It's challenging to determine this with absolute confidence, since nobody truly knows their lifespan.

You could create a plan considering the typical lifespan in the UK, where men live up to an average of 78.6 years and women to 82.6 years, as per data from the Office for National Statistics. latest government figures .

Should you decide to claim your pension when you turn 55, it would typically need to suffice for approximately 25 years on average.

Should I retire abroad?

Fleeing Britain’s inclement weather for more temperate locales is a common choice, however, there are additional elements to ponder when planning retirement overseas, which might necessitate an even bigger savings fund.

If you're planning to retire in a popular European Union country, you will probably require a visa along with proof of financial means to support yourself. Each EU member state has its individual threshold for minimum income.

UK retirees must also take care when retiring to France or receiving their pension in Spain As the 25% tax-free withdrawal rule doesn’t apply when accessing funds whilst residing in these nations, residents of France and Spain may also be subject to a wealth tax. This could potentially decrease your overall income.

In contrast, retiring in Portugal It might appeal more to individuals with substantial pensions since there’s no wealth tax, along with only a 20% taxation rate on foreign pension income.

Nobody can foresee the extent to which bills might increase, nor the effect that inflation or interest rates could have on your earnings once you retire. Thus, calculating how much money you'll require for your later life is quite complex; however, the straightforward solution may be—save as much as feasible.

Enjoy The Telegraph’s extensive selection of Puzzles – getting smarter daily has never been more enjoyable. Challenge your mind and enhance your spirits with PlusWord, the Compact Crossword, the demanding Killer Sudoku, and even the traditional Cryptic Crossword.

Comments

Post a Comment