Can You Have Multiple ISAs? Here's What You Need to Know

Previously capped, there is now no restriction on the quantity of Isas an individual may possess, nor limitations on opening or contributing to multiple accounts within the same fiscal year.

You could decide to start a new one cash Isa If, for example, you come across another account offering a more attractive interest rate, you could decide to open a new one. stocks and shares Isa If you notice one that has lower fees compared to what you're currently paying on your existing account.

At this point, Telegraph Money outlines the most recent Isa regulations.

- How many Individual Savings Accounts (Isas) can you open within one tax year?

- What happens with ISAs from earlier tax years?

- Is it prudent to hold several varieties of ISAs?

- Is it possible to inherit an ISA?

How many Individual Savings Accounts (Isas) can you open within one tax year?

You can open as many Isas as you wish within one tax year. Nonetheless, it’s important to consider your decision thoroughly prior to making deposits into an Isa.

Ask yourself:

- Are the interest rates offered by the Isa you're thinking about comparable to those available elsewhere?

- If there are charges linked to the account, are they justified and can you find better deals somewhere else?

Based on the kind of account you have, you might not be allowed to withdraw your funds and transfer them to a more advantageous option — for example, certain fixed-rate ISAs could require you to wait till the conclusion of the fixed period before you're able to shift your money around.

If you can withdraw funds, you typically won't recoup the exact amount you put in. Isa allowance If you're uncertain, consult the service provider beforehand to avoid any issues when setting up your account.

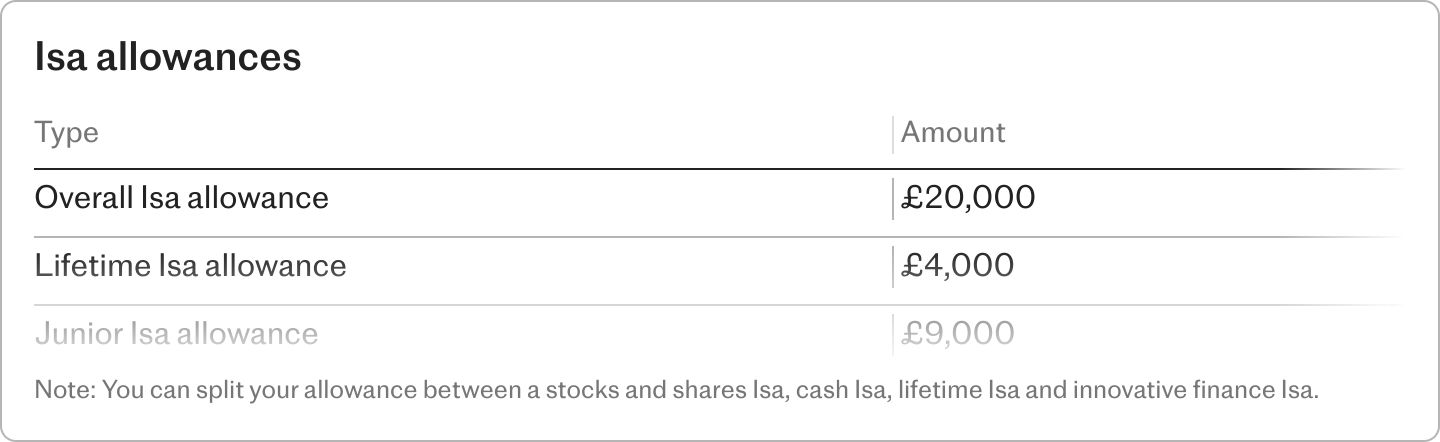

It's crucial to keep in mind that although you have the option to open numerous Isas, your overall contribution limit remains at £20,000 for all accounts combined.

Recommended

Is it possible to deposit £20,000 into an ISA each year?

Read more

What happens with ISAs from earlier tax years?

ISAs that were opened in previous tax years typically remain untouched by new accounts.

If you like, you can continue paying into Isas that you opened during previous tax years instead of opening new ones, otherwise you can leave the money in those existing accounts or make an Isa transfer to move it to a new account.

Is it prudent to hold various kinds of ISAs?

It’s completely usual to have several kinds of ISA, since each has a distinct function – the challenging aspect is ensuring you do not exceed the limits or overlap them. go beyond your yearly Individual Savings Account (Isa) allowance .

You could choose a cash ISA if you're looking to earn interest on your savings without paying taxes. For investing your funds and avoiding taxation on the profits, a stocks and shares ISA might be more appropriate for you.

You could opt for having both. Our guide to the best cash Isas Can assist you stay ahead with the most competitive accounts, featuring daily-updated tables. Also, make sure not to overlook our guide to the top Stocks and Shares ISAs for investment choices to think about.

If you're saving for your first house or planning for retirement and fall within the age range of 18 to 39, you might consider opening one as well. lifetime Isa .

These accounts provide a 25% government bonus of up to £1,000 annually on your savings, coupled with either interest or investment gains. Here’s our guide to them. best lifetime Isa providers Can assist you in selecting the appropriate account for your needs.

Ensure you understand the deposit limitations for whichever type of ISA you're thinking about. This information is provided in the table below.

Is it possible to inherit an ISA?

ISAs form part of your estate, so the funds within them can be passed down to your beneficiaries; however, they might incur inheritance tax. You won’t have to worry about income tax on these amounts. capital gains tax To settle all outstanding payments until the account is closed, this closure occurring either when the executor of your estate finalises it or upon completion of the estate’s administration. Should neither occur, your service provider will shut down the account three years and a day following your passing.

If Isas are transferred to your spouse upon death, this can occur without attracting taxes. Thanks to the Additional Permitted Subscription (APS) rules, widows or widowers have the option of receiving the entire amount from an inherited Isa along with their regular Isa limit.

Our guide outlines all the regulations thoroughly. How to ensure your spouse can inherit your ISA .

Enjoy The Telegraph’s fantastic selection of Puzzles – gaining sharper cognitive skills each day. Challenge your mind and enhance your spirits with PlusWord, the Petite Crossword, the daunting Killer Sudoku, and even the traditional Cryptic Crossword.

Comments

Post a Comment